Smart travel expense management for SMEs

In this article we'll cover:

- Which business travel expenses are tax-deductible

- Tools you can use to streamline and automate your travel expense management

- Top travel expense management apps

- Why small businesses need a travel expense policy and how to write one

Travel expenses can be one of the largest costs incurred by any business, big or small. That’s why having a policy in place to monitor the reporting and reimbursement of business travel expenses is vital – not only to keep costs to a minimum, but also to keep your employees and the business safe.

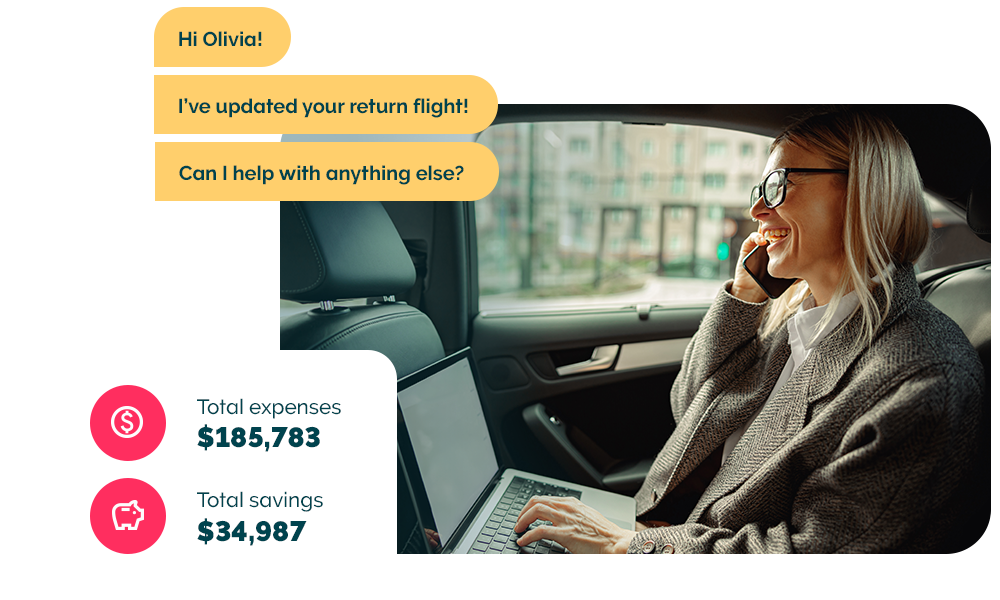

It's time for better business travel management

With the perfect balance of modern travel technology and dedicated experts, you really can have the best of both worlds.

- Dedicated travel consultant

- Intuitive all-in-one travel platform

- Search, book, and report in minutes

- 24/7 emergency support & live chat

- Traveller tracking & duty of care dashboard

- Exclusive Deals, negotiated rates, and more!

About Flight Centre Travel Group

The Flight Centre Travel Group is one of the world’s largest travel retailers and corporate travel managers. The company, which is headquartered in Brisbane, Australia, has company-owned leisure and corporate travel business in dozens of countries, spanning Australia, New Zealand, the Americas, Europe, the United Kingdom, South Africa, the United Arab Emirates, and Asia. ASX listed Flight Centre Travel Group (FLT) also operates the global FCM corporate travel management network, which extends to more than 100 countries through company-owned businesses and independent licensees, along with Corporate Traveller, the flagship business specific to the small-to-medium-sized enterprise sector. For more information, visit fctgl.com.